HCI SYSTEM > TOOLSET

Industrial Strategy Analysis

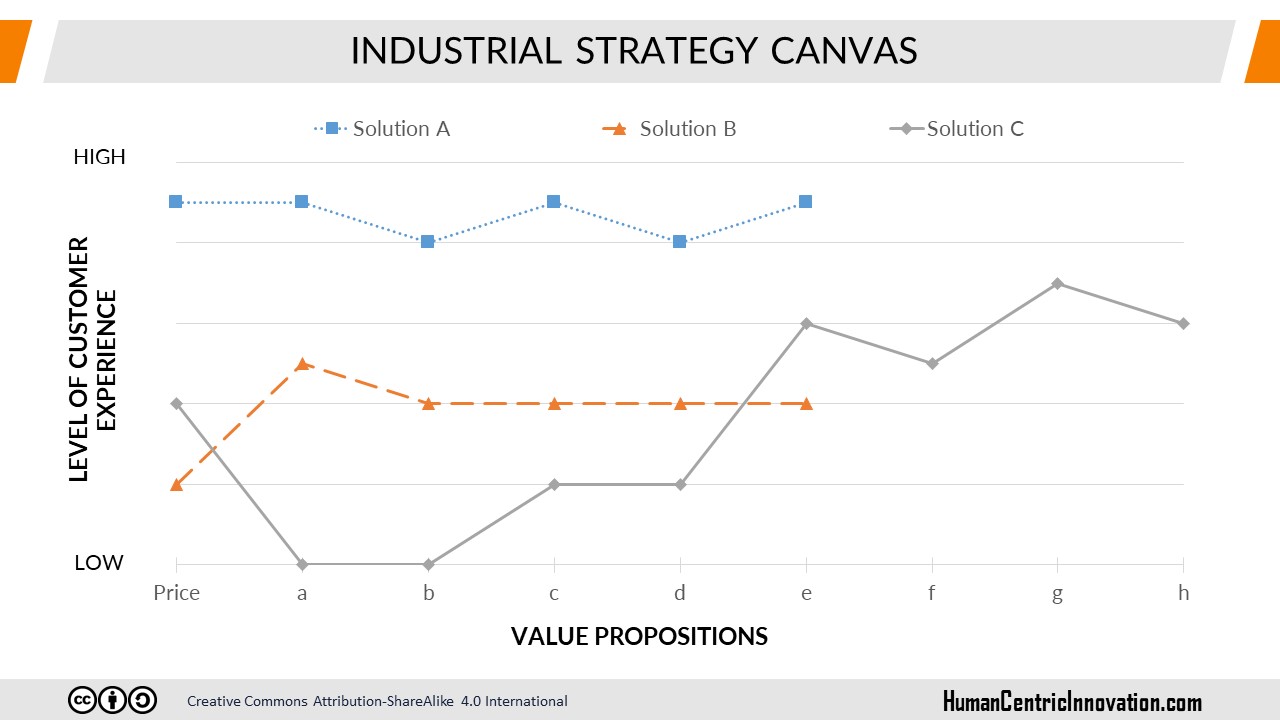

Looking at industries from a critically discerning perspective is a great way to capture unmet needs of all the audiences targeted by them. While explaining the Blue Ocean Strategy, Chan Kim and Renee Mauborgne suggest a useful tool to do this. This tool clearly shows three of the main elements of the dominant strategic configuration in an industry. The first is the factors the industry competes with, namely its primary value propositions. The second is what customers experience or can obtain on the basis of these factors. The third is the strategic profiles of all solutions in the industry.

The outcome of the analysis is a two-axis graph. On the horizontal axis of the graph, there are the main factors the industry competes with by continually investing. The vertical axis indicates the level of customer experience that each one of the existing solutions can offer along each competition factor. A solution that scores high for a specific competition factor on the vertical axis means it provides a better experience for customers. The lines formed by determining the levels of existing solutions in terms of all factors show the strategic profiles of those solutions.

The outcome of this tool is used in the Customer Utility Analysis tool.

The outcome of the analysis is a two-axis graph. On the horizontal axis of the graph, there are the main factors the industry competes with by continually investing. The vertical axis indicates the level of customer experience that each one of the existing solutions can offer along each competition factor. A solution that scores high for a specific competition factor on the vertical axis means it provides a better experience for customers. The lines formed by determining the levels of existing solutions in terms of all factors show the strategic profiles of those solutions.

The outcome of this tool is used in the Customer Utility Analysis tool.

How It Works?

Step 1

Determine Competitive Factors

Identify key factors the industry competes with, no fewer than five and no more than twelve. When identifying these factors, consider the following:- Look from the perspective of industry players because the goal is to extract the industry's viewpoint. The customer's perspective will come into play in later stages. To understand what the industry values, you can examine where it invests and what it communicates most to its customers. Often, there's a discrepancy between what companies think is valuable to their customers and what most customer groups truly value. The path to innovative solutions lies in identifying this discrepancy.

- When conducting this study for B2B industries, there's a frequent mistake of assuming that the products sold are standardized and that the most distinguishing factor in competition is price. Don't forget other important factors in these industries, such as solution evaluation, technical support services, delivery times, and stock availability.

- Organizational factors that customers can't experience (e.g., competent human resources, strong IT infrastructure) should not be considered as a value proposition. If there is an organizational factor that is competitive and experienced by the customer, it should be expressed in terms of the value offered to the customer. For example, if competent human resources allow companies to provide customized solutions quickly and flexibly and this is a significant competitive element, instead of writing "competent human resources," write "customized solution speed and flexibility."

- Brand strength is often listed as an essential competitive factor. However, it's crucial to remember that a brand is often a product of the strategic profiles of the solutions a company offers. The power of a brand is determined by its level of awareness and the allure of the values it evokes. A brand that consistently lets customers experience an attractive set of values will become more well-known. For example, the Apple brand is strong because Apple products consistently offer customers an attractive set of values (simplicity, ease of use, elegance, quality, luxury). With this perspective, instead of adding "brand strength" to the list of competitive factors, it would be more accurate to write the factors that create that strength.

Login or register for free to get the full content.